Key Points

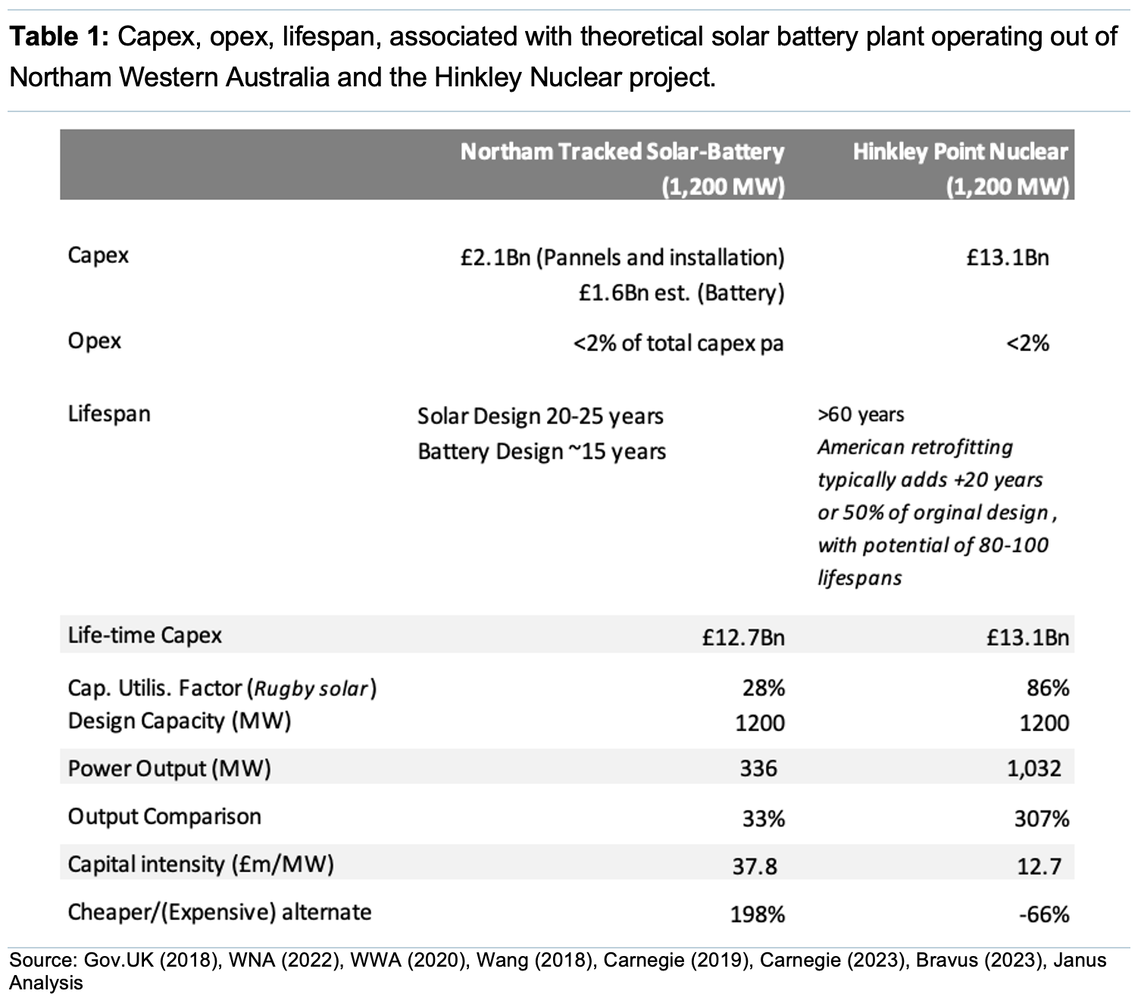

- Have modelled a 1,200MW Hinkley C nuclear power plant versus a tracked solar power plant, using actual data from two optimal cloudless summer days, zero transmission losses;

- Construction costs were updated late last year;

- Used most recent Stage III published capex for Vistra Moss to estimate battery costs, adjusted to be capable of 12-hour storage;

- Assuming a 60-year lifespan, our solar project with battery backup has a 198% greater capex intensity than our baseline equivalent Hinkley C project.

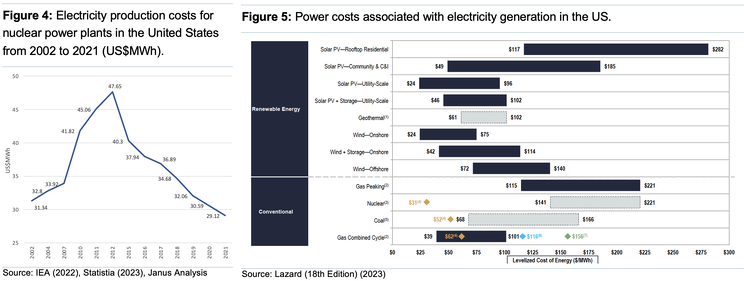

Energy cost comparative diagrams (see Appendix A) typically show nuclear power as being substantially more expensive than solar energy sources and solar battery combinations. The occurrence of large-scale wind/solar projects with dedicated battery storage do not yet exist economically. Thereby raising the obvious question – how can one accurately assign costs?

This is more than a theoretical exercise, as we compare a number of recent and relevant componentry costs. Collectively, this can be transcribed as an equivalent solar trajectory plant with a battery storage solution. We have included a number of positive assumptions Including a unrealistic solar harvesting model (e.g. energy coefficient, size of solar array, zero decommissioning costs and no lost output for disassembly and reassembly) to aid it in its capex intensity comparison, an important factor in solar generation. We will then compare that with the Hinkley C nuclear project in the UK, which incidentally, is regarded as the worst managed nuclear project globally[1], given how much it has run over budget and time. Although, this should not be surprising, analysis[2] of 75 U.S. nuclear plants found that cost estimates throughout construction increased between 100 and 300% of initial forecast, although it has to be noted that much of this is down to regulatory delays, covering a period of elevated inflation.

Operating Assumptions

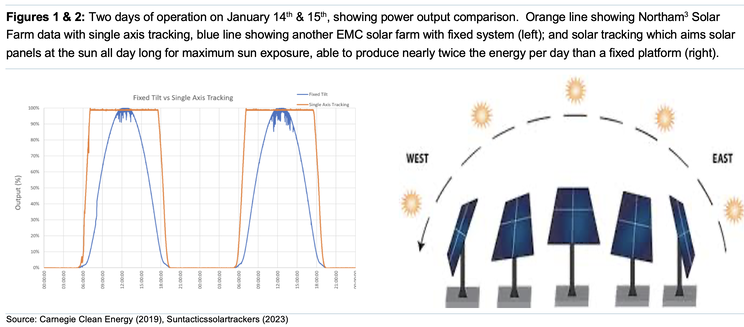

Our solar production model is based upon an actual microgrid operation with single axis tracking, covering power output over two peak summer days (see Figure 2), assumptions include:

- The power output used in this model was measured at the height of summer, on two cloudless days, within a month of the southern solstice[4]. Obviously, this consistency of solar radiation is an unrealistic harvesting scenario (outside the Atacama, Chile), but used this assumption as a conservative measure. The point being, under normal conditions, the number of panels, area and capex required would be several times larger again;

- Nuclear power plants are unaffected by clouds, weather or seasonality;

- At 10MW generation capacity, the Northam Solar Farm required 25 hectares (62 acres); therefore, a 1.2GW Northam Solar Farm would, by comparison, have to cover 7,400 acres (3,000 hectares) or 30sqkm;

- Includes sufficient battery capacity to store solar energy to supply 1.2GW, assuming zero transmission losses, over a 12-hour period at night, which would require 60sqkm;

- A 1.2GW nuclear power station would occupy >300 hectares (3sqkm), the vast majority of the area being used as a safety margin around the plant;

- Modern silica solar panels have a recommended lifespan of between 20-25 years;

- New nuclear power plants have an average 80+ year lifespan – meaning a comparable solar project would have to be constructed at least four times over[5];

- If a 10MW solar power plant requires 34,000 solar panels; ceteris paribus (all else being equal), it would require 4,080,000 panels to generate 1,200MW (for half a day), with more than eight million for the entire day;

- The storage solution estimated capex used the world’s largest battery storage unit, the 750MW/3,000MWh Vistra Moss Landing Energy Storage Facility, California. Recently, it completed its third expansion, totalling 350MW/1,400MWh, and costing between US$500-$600m; and

- In our previous work looking at long-term battery costs, we suggested that these capital numbers are unlikely to lessen into the future, given that processing, refining (e.g. lithium, nickel) and manufacture is relatively fixed, and related to the underlying energy cost.

Capex Assumptions

These numbers suggest:

- A battery capable of storing 1,200MW output over a 12-hour period would have a capex in the vicinity of US$2Bn[6], though prone to fire-risk[7], they have a life-expectancy estimated ~15-years;

- An updated cost estimate[8] to rebuild the Northam Solar Farm was ~AUD$18m, ceteris paribus, our 1,200MW solar farm (containing eight million panels) costing ~$2.7Bn;

- Purchasing underlying agricultural land estimated at ~A$6,000 per hectare[9] or US$23m;

- Not accounting for degradation rate for solar panels estimated from 0.5 to 0.7% pa;

- No decommissioning costs or no lost output for disassembly and reassembly;

- Over a 60-year timeframe, we have treated all the replicant solar panel and battery costs[10] as being up-front (i.e. panels being replaced three times, and the batteries, four), no transmission losses, using peak summer time harvest capacity, modest one-off land cost in Western Australia; results in a total capex ~$14.5Bn;

- Calculated in nominal terms, we have not attempted to predict or adjust for future inflation (which mitigates the potential future upward liability of solar battery capex replacement); and

- Hinkley C will produce ~3,200Mw, with current estimates at £35Bn[11] – so comparing like for like outputs, the cost for a 1200MW nuclear plant would be ~£13.1Bn (US$15.6Bn).

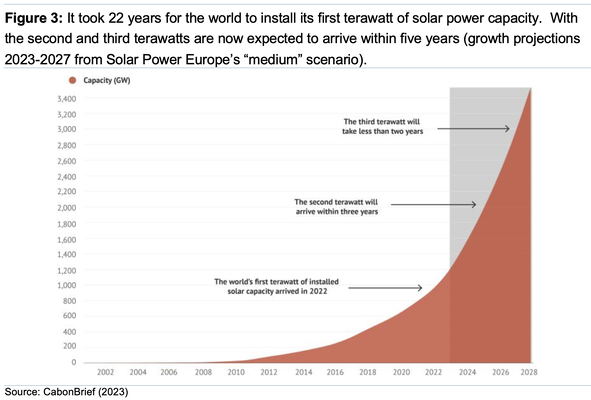

According to Orsted up to 95% of the turbines are fully recyclable[12], compared to only 40-60% of an average solar panel. Brackets, stands, and frames are recoverable, but the polymers often contain heavy metals, with the affixed glass being typically too difficult to treat. A 2021 MIT study[13] suggested that only around 10% of panels in the US are recycled due to the expense. The University of NSW estimated that the world has recently installed more than one terawatt of solar capacity (see Figure 3). Given that ordinary solar panels have a capacity of about 400W, if you count both rooftops and solar farms, there could be as many as 2.5Bn solar panels globally. Life expectancy is 20 (polymer) to 25 (silica) years – although real world conditions suggests that it is typically less.

While some commentators suggest that wind and solar will replace the majority of current fossil fuel use, we believe that scenario highly unlikely due to the lack of near-term battery technology complementing dispatchable resources (i.e. mimicking baseload is challenging). It so happens that the second largest source of low emissions power (after hydropower[14]) is nuclear power. A single tonne of natural uranium can create more than 40,000MWh of electricity. Equivalent to burning 16,000t of high-grade thermal coal or 80,000 barrels (~12,700t) of oil.

In other words, it would take a 10MW Northam Solar Farm ~20 months of operation in the midst of cloudless days at the height of continual summer to match the amount of power generated by a single tonne of U3O8.

Appendix A

Footnotes

[1] Ignoring the Plant Vogtle third nuclear reactor, simply because it is an addition to an existing site, the first two reactors were installed in the 1980s, according to the WSJ, the fourth commenced commercial operations in 29/4/24.

[3] Northam is located 31 degrees 40 minutes South, in Western Australia. The angle of incidence determines how effectively sunlight is captured by solar panels, and refers to the angle at which sunlight strikes a surface of the solar collector, relative to a line perpendicular (90 degrees).

[4] Solar panels are tested at a benchmark of 25 degrees C. For every degree rise in temperature above this level, the efficiency is reduced by 0.5%. The temperature level refers to the solar cell rather than the air temperature, therefore, in direct sunlight in the middle of summer in WA, cells temperatures could easily reach 60-80 degrees Celsius. We have ignored this factor, needlessly complicating things.

[5] Note that in this exercise we have assumed a 60 year lifespan.

[6] Power (P) is the rate at which energy is used or produced, and it’s measured in watts (W) or megawatts (MW). Energy (E) is the total amount of work done or produced and is measured in watt-hours (Wh) or megawatt-hours (MWh). Given the Vistra Moss Storage Facility (example above) Battery Power (P) = 350MW & Battery Energy Capacity (E) = 1,400MWh. Duration = 1,400MWh/ 350MW = 4 hours. Therefore, need 3x the facilities. If we look at Calpine’s billion-dollar Nova Power Bank (620MW), capable of powering ~680k homes for up to four hours when charged, you would need to almost double its capacity to reach our proposed 1,200MW, and then triple the size from 4 for 12 hours power output. Implies a rough capex of ~$5.2Bn, which is >150% higher than our battery solution estimate of $2Bn; but this merely confirms the conservative nature of our capex estimates.

[7] Vistra Moss Facility had two fire incidents last year.

[8] https://igeh2.com/ige-completes-northam-solar-farm-acquisition-targets-commercial-output-in-2024/ – Therefore, 8m panels/34k from the original farm = 235.3 x A$18m (new estimate) = $4.24Bn or US$2.72Bn.

[9] In its latest annual Australian Agricultural Land Price Outlook, Rabobank suggested that transacted prices paid for farmland in Western Australia was ~$6,000/ha (closer to Perth). Assuming we need 6,000 hectares or 60sqkm, equates to ~$36m or ~US$23m (assuming a AUD/USD 0.64). We would point out that the average cost in Kent, UK, is £10,600 an acre, if you re-run that calculation, the cost is ~US$201m (assuming a GBP/USD 1.28).

[10] We think this a legitimate methodology. The solar plant will need to be constructed and disassembled three and the battery four times for the lifespan of a single nuclear power plant. Moreover, future solar costs will be dramatically influenced by the prevailing inflation rate, so any future nominal amount will be considerably higher than that quoted today.

[11] FT (2023) op cit.

[12] Turbine blades are typically made of fibreglass or carbon fibre, held together with resin, and cannot be easily or efficiently recycled; although there are solutions currently being found – https://cen.acs.org/environment/recycling/companies-recycle-wind-turbine-blades/100/i27

[14] There are natural limitations to both sources of power. Firstly, in many places around the world, most hydropower sites have already been utilised, with the capacity to expand further constrained. By contrast, the limiting factor for the expansion of nuclear power is intellectual. The UK was the first country globally to build a commercial nuclear power plant, but now it relies on the French EDF for its next generation of nuclear reactors.

Disclosures

This document is provided for information purposes only and should not be regarded as an offer, solicitation, invitation, inducement or recommendation relating to the subscription, purchase or sale of any security or other financial instrument. This document does not constitute, and should not be interpreted as, investment advice. It is accordingly recommended that you should seek independent advice from a suitably qualified professional advisor before taking any decisions in relation to the investments detailed herein. All expressions of opinions and estimates constitute a judgement and, unless otherwise stated, are those of the author and the research department of Janus Analysis only, and are subject to change without notice. Janus Analysis is under no obligation to update the information contained herein. Whilst Janus Analysis has taken all reasonable care to ensure that the information contained in this document is not untrue or misleading at the time of publication, Janus Analysis cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. This document is not guaranteed to be a complete statement or summary of any securities, markets, reports or developments referred to herein. No representation or warranty either expressed or implied is made, nor responsibility of any kind is accepted, by Janus Analysis or any of its respective directors, officers, employees or analysts either as to the accuracy or completeness of any information contained in this document nor should it be relied on as such. No liability whatsoever is accepted by Janus Analysis or any of its respective directors, officers, employees or analysts for any loss, whether direct or consequential, arising whether directly or indirectly as a result of the recipient acting on the content of this document, including, without limitation, lost profits arising from the use of this document or any of its contents.

This document is provided with the understanding that Janus Analysis is not acting in a fiduciary capacity and it is not a personal recommendation to you. Investing in securities entails risks. Past performance is not necessarily a guide to future performance. The value of and the income produced by products may fluctuate, so that an investor may get back less than he invested. Investments in the entities and/or the securities or other financial instruments referred to are not suitable for all investors and this document should not be relied upon in substitution for the exercise of independent judgment in relation to any such investment.

Janus Analysis may have issued other documents that are inconsistent with and reach different conclusions from, the information contained in this document. Those documents reflect the different assumptions, views and analytical methods of their authors. No director, officer or employee of Janus Analysis is on the board of directors of any company referenced herein and no one at any such referenced company is on the board of directors of Janus Analysis.

Analysts’ Certification

The analysts involved in the production of this document hereby certify that the views expressed in this document accurately reflect their personal views about the securities mentioned herein. The analysts point out that they may buy, sell or already have taken positions in the securities, and related financial instruments, mentioned in this document.